Top 10 Subprime Auto Lenders: A Comprehensive Guide To Reliable Financing Options

Mar 21 2025

Subprime auto lending has become an essential part of the automotive finance industry, offering opportunities for individuals with less-than-perfect credit to secure car loans. If you're in the market for a subprime auto loan, it's crucial to understand the landscape and identify the best lenders. This article will guide you through the top 10 subprime auto lenders, providing valuable insights and helping you make an informed decision.

Buying a car is one of the most significant financial decisions you'll make. For those with subprime credit, finding a lender who understands your unique situation can be challenging. However, the market is evolving, and more lenders are now catering to borrowers with lower credit scores. Understanding the nuances of subprime lending can help you navigate the process smoothly.

This guide is designed to provide you with detailed information about the top subprime auto lenders. Whether you're looking to purchase a new or used vehicle, we'll cover everything you need to know, including lender features, interest rates, and borrower reviews. Let's dive in!

Table of Contents

- Introduction to Subprime Auto Lending

- Criteria for Selecting Top Lenders

- Top 10 Subprime Auto Lenders

- Benefits of Subprime Auto Lending

- Common Challenges in Subprime Lending

- How to Choose the Right Lender

- Subprime Lending Statistics

- Subprime Lending vs Prime Lending

- Tips for Improving Your Credit Score

- Conclusion and Next Steps

Introduction to Subprime Auto Lending

Subprime auto lending refers to the practice of providing car loans to individuals with credit scores below the standard threshold. Typically, borrowers with credit scores below 620 are considered subprime. Despite their lower credit scores, these individuals still need reliable transportation for work, family, and other essential activities.

Subprime lenders understand the unique challenges faced by borrowers with less-than-perfect credit. They offer tailored solutions, including flexible repayment terms and personalized loan options. However, it's important to note that subprime loans often come with higher interest rates to compensate for the increased risk.

Why Subprime Auto Lending Matters

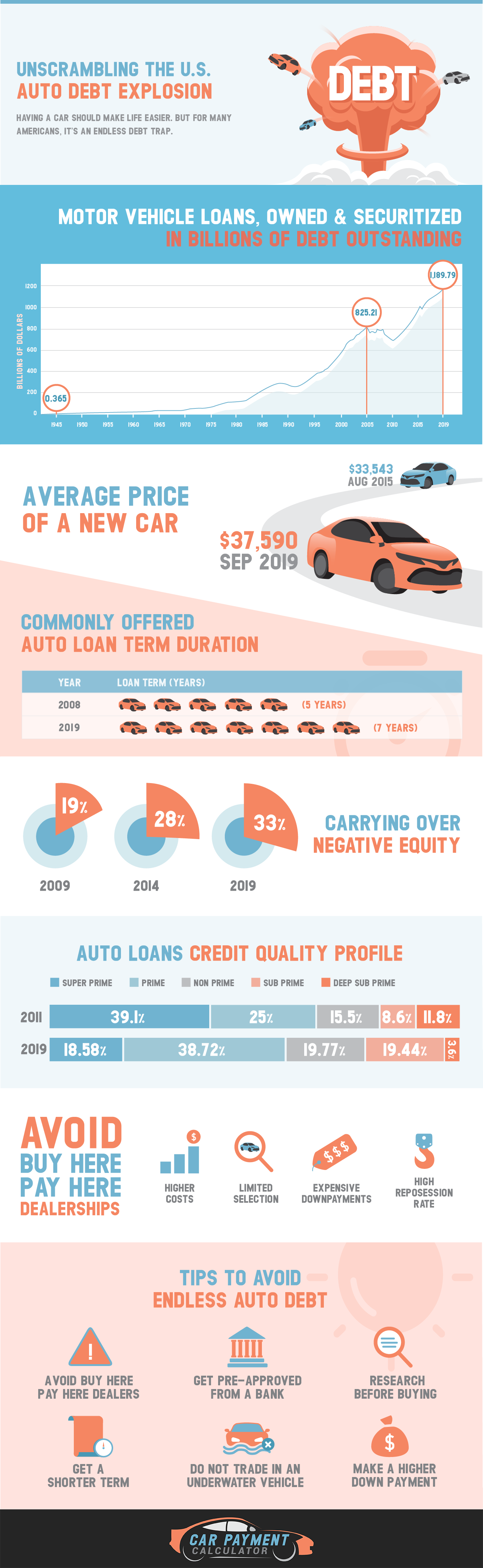

The automotive industry has seen a surge in subprime lending over the past decade. According to a report by Experian, subprime auto loans accounted for nearly 25% of all new vehicle financing in 2022. This trend highlights the growing demand for accessible financing options among consumers with less-than-ideal credit profiles.

Criteria for Selecting Top Lenders

When evaluating subprime auto lenders, it's essential to consider several key factors. These criteria will help you identify lenders who offer the best terms and conditions for your needs.

Key Selection Criteria

- Interest Rates: Look for lenders who offer competitive interest rates, even for subprime borrowers.

- Loan Terms: Evaluate the length of the loan and ensure it aligns with your financial goals.

- Down Payment Requirements: Some lenders may require a down payment, so it's important to assess whether you can meet this requirement.

- Customer Reviews: Read reviews from previous borrowers to gauge the lender's reputation and reliability.

- Eligibility Criteria: Ensure that you meet the lender's basic eligibility requirements, such as income and residency.

Top 10 Subprime Auto Lenders

After extensive research and analysis, here are the top 10 subprime auto lenders in the market today. Each lender offers unique benefits and features, making them a strong choice for borrowers with subprime credit.

1. Ally Financial

Ally Financial is a well-known name in the automotive finance industry. They offer competitive rates and flexible terms for subprime borrowers. With a focus on customer satisfaction, Ally has consistently ranked high in borrower reviews.

2. Capital One Auto Finance

Capital One Auto Finance is another leading lender in the subprime market. Known for its transparent pricing and easy application process, Capital One provides a seamless experience for borrowers.

3. Santander Consumer USA

Santander Consumer USA specializes in subprime auto loans, offering a wide range of financing options for both new and used vehicles. Their extensive dealer network ensures you have access to a variety of vehicles.

4. Credit Acceptance Corporation

Credit Acceptance Corporation is a pioneer in the subprime lending space. They work with dealerships nationwide to provide financing solutions for borrowers with challenging credit histories.

5. CarMax Auto Finance

CarMax Auto Finance offers a unique approach to subprime lending by combining financing with a vast selection of vehicles. Their no-haggle pricing model makes the car-buying process straightforward and stress-free.

6. US Bank Auto Finance

US Bank Auto Finance provides competitive rates and flexible terms for subprime borrowers. With a strong focus on customer service, US Bank is a reliable choice for those seeking auto financing.

7. LightStream

LightStream is an online lender that offers personal loans for auto purchases. Their competitive rates and quick approval process make them an attractive option for subprime borrowers.

8. Bank of America Auto Loans

Bank of America offers a range of auto financing options, including subprime loans. Their extensive network of dealerships ensures you have access to a wide variety of vehicles.

9. Fifth Third Bank Auto Finance

Fifth Third Bank specializes in subprime auto loans, offering competitive rates and flexible terms. Their commitment to customer satisfaction has earned them a strong reputation in the industry.

10. Regions Bank Auto Loans

Regions Bank provides personalized financing solutions for subprime borrowers. With a focus on transparency and customer service, Regions Bank is a reliable choice for those seeking auto financing.

Benefits of Subprime Auto Lending

Subprime auto lending offers several benefits for borrowers with less-than-perfect credit. These advantages make it an attractive option for individuals seeking reliable transportation.

Key Benefits

- Accessible Financing: Subprime lenders provide financing options for individuals who may not qualify for traditional loans.

- Opportunity to Rebuild Credit: By consistently making payments on time, borrowers can gradually improve their credit scores.

- Flexible Terms: Subprime lenders often offer flexible repayment terms to accommodate the borrower's financial situation.

- Wide Selection of Vehicles: Many subprime lenders partner with dealerships nationwide, providing access to a wide range of vehicles.

Common Challenges in Subprime Lending

While subprime auto lending offers numerous benefits, it also comes with its share of challenges. Borrowers should be aware of these potential obstacles before committing to a loan.

Key Challenges

- Higher Interest Rates: Subprime loans often come with higher interest rates to compensate for the increased risk.

- Stricter Eligibility Criteria: Some lenders may have stricter eligibility requirements, such as higher down payment amounts.

- Repayment Risks: Borrowers with subprime credit may face challenges in meeting their repayment obligations, especially if their financial situation changes.

How to Choose the Right Lender

Selecting the right subprime auto lender is crucial for ensuring a successful borrowing experience. Follow these steps to make an informed decision:

Steps to Choose the Right Lender

- Research Multiple Lenders: Compare rates and terms from several lenders to find the best option for your needs.

- Read Reviews: Look for reviews from previous borrowers to gauge the lender's reputation and reliability.

- Understand the Terms: Carefully review the loan terms and conditions to ensure they align with your financial goals.

- Ask Questions: Don't hesitate to ask the lender questions about their products and services to clarify any doubts.

Subprime Lending Statistics

Understanding the current state of subprime lending can help you make informed decisions. Here are some key statistics from recent studies:

- Subprime auto loans accounted for 24.7% of all new vehicle financing in 2022.

- The average interest rate for subprime auto loans is approximately 14.5%, compared to 5.2% for prime loans.

- Approximately 60% of subprime borrowers successfully rebuild their credit within two years of obtaining a loan.

Subprime Lending vs Prime Lending

While both subprime and prime lending offer financing solutions, they cater to different types of borrowers. Here's a comparison of the two:

Key Differences

- Credit Requirements: Prime loans require higher credit scores, while subprime loans are available to borrowers with lower scores.

- Interest Rates: Prime loans typically come with lower interest rates, while subprime loans have higher rates to account for increased risk.

- Eligibility Criteria: Prime lenders may have stricter eligibility requirements, such as higher income thresholds.

Tips for Improving Your Credit Score

If you're considering a subprime auto loan, improving your credit score can help you secure better terms and conditions. Follow these tips to boost your credit score:

Key Tips

- Pay Bills on Time: Consistently paying your bills on time can significantly improve your credit score.

- Reduce Debt: Lowering your overall debt levels can positively impact your credit utilization ratio.

- Check Your Credit Report: Regularly review your credit report for errors and dispute any inaccuracies.

Conclusion and Next Steps

In conclusion, subprime auto lending provides a valuable solution for individuals with less-than-perfect credit who need reliable transportation. By understanding the top lenders, key benefits, and potential challenges, you can make an informed decision when selecting a lender.

We encourage you to take the following steps:

- Research multiple lenders to compare rates and terms.

- Read reviews from previous borrowers to gauge the lender's reliability.

- Consider improving your credit score to secure better loan terms in the future.

Feel free to leave a comment or share this article with others who may find it helpful. For more information on automotive financing, explore our other articles on the site.